Modern CX for Semiconductor Manufacturers

The Semiconductor and Discrete CX Challenge Today

Yet, most organizations are still working with:

Fragmented design-in and design-win tracking across partners

Manual pricing, ship-and-debit, and claim workflows

Limited visibility across channel demand, POS, and forecasting

Key CX Problems and How We Solve Them

Fragmented Design-In and Design-Win Tracking

Problem

- Multiple touchpoints across OEMs and EMS partners

- Lack of visibility into BOMs and design conversion

- Lost socket wins due to slow follow-up

Solution

- Design lifecycle tracking

- Socket win visibility

- Integrated FAE and sales workflows

Inconsistent Pricing and Manual S and D Management

Problem

- Distributors manage multiple pricing tiers

- Claim validation is manual and slow

- Difficult to trace claims to actual POS

Solution

- Automated S and D processing

- POS reconciliation

- Rule-based margin control

Unreliable Forecasting Across Tiers

Problem

- Volatile downstream demand

- Conflicting OEM and distributor forecast

- Poor supply-demand alignment

Solution

- Combined internal and channel forecasting

- AI-led demand anomaly detection

- POS-driven planning

Channel Complexity and Conflict

Problem

- Design and deal registrations lead to disputes

- Limited visibility into channel sales

- Duplicate claims and unclear incentives

Solution

- Unified partner workflows

- Compliance-based claim approvals

- Real-time channel performance tracking

Missing BOM and Lifecycle Intelligence

Problem

- No central repository for BOMs

- Missed opportunities for alternate parts

- EOL risks managed offline

Solution

- BOM mapping and alerts

- Lifecycle and alternate tracking

- Engineering collaboration tools

Margin Leakage from Ad-Hoc Pricing

Problem

- Pricing requests lack guardrails

- Profitability is unclear during quoting

- Contracts are not aligned with performance

Solution

- Threshold-based discounts

- CPQ-integrated margin visibility

- Quote analysis by product and region

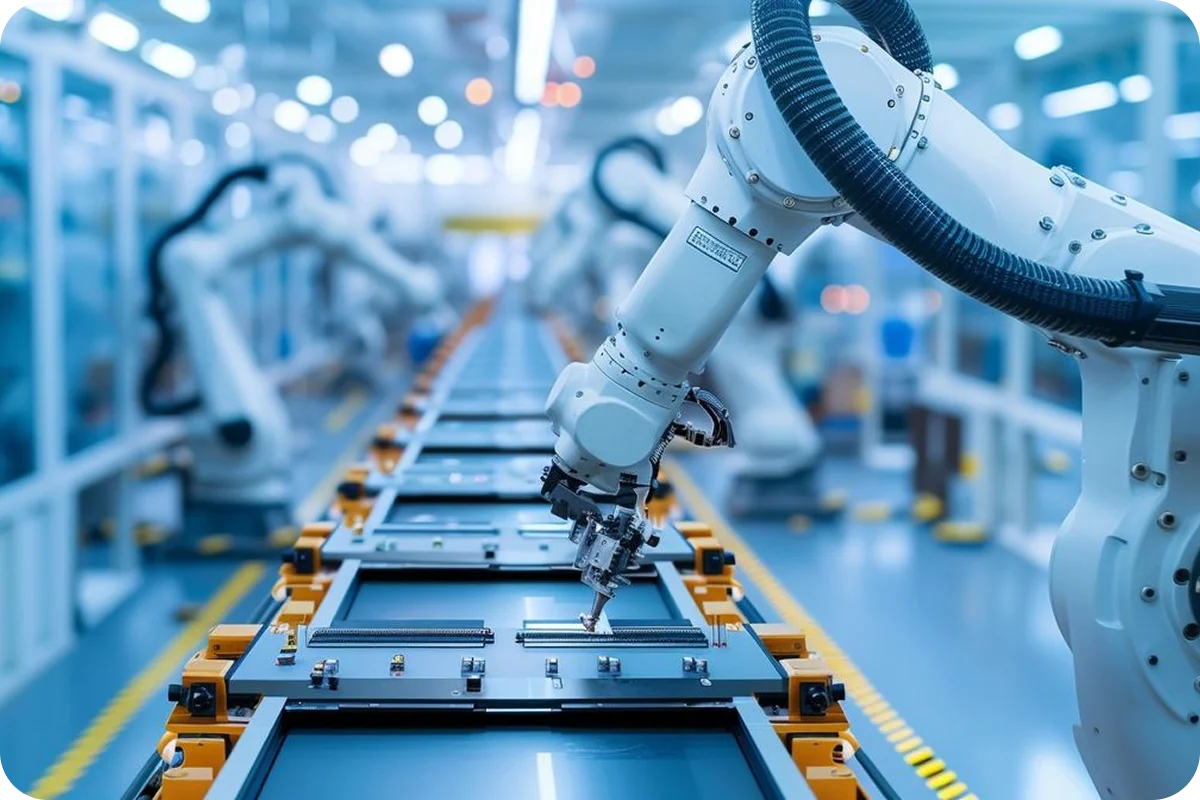

Connected CX Across the Semiconductor Lifecycle

Design and Engineering

Design-in tracking, socket visibility, BOM lifecycle insights

FAE and Sales

Unified workflows for engineers, reps, and opportunity management

Pricing and CPQ

Special pricing requests, margin controls, approvals

Channel Operations

Distributor deal registration, POS and claim validation

Ship and Debit Management

Automated processing, reconciliation, and audit trails

Forecasting and Planning

Tier-wise demand visibility and consumption analytics

Customer and Partner Experience

Self-service portals for pricing, BOMs, and support

Service and Returns

RMA workflows, issue tracking, and engineering support

Why Semiconductor and Discrete Manufacturers Choose Suavisinc

Deep domain expertise in design-wins and multi-tier channel models

Strong understanding of OEM, EMS, and distributor ecosystems

Platform-neutral architecture across CRM, CPQ, PRM, and ERP

Advanced pricing, CPQ, and ship-and-debit automation

Outcome-driven delivery focused on margin, speed, and visibility

How We Work With Engineering and Construction Clients

CX Roadmap & Strategy

Assessment of design, pricing, channel, and forecasting workflows.

Solution Selection & Architecture

Vendor-neutral evaluation across CRM, CPQ, PRM, pricing, and forecasting tools.

Implementation & Integration

Deployment of socket tracking, pricing governance, claim automation, and portals.

Change Management

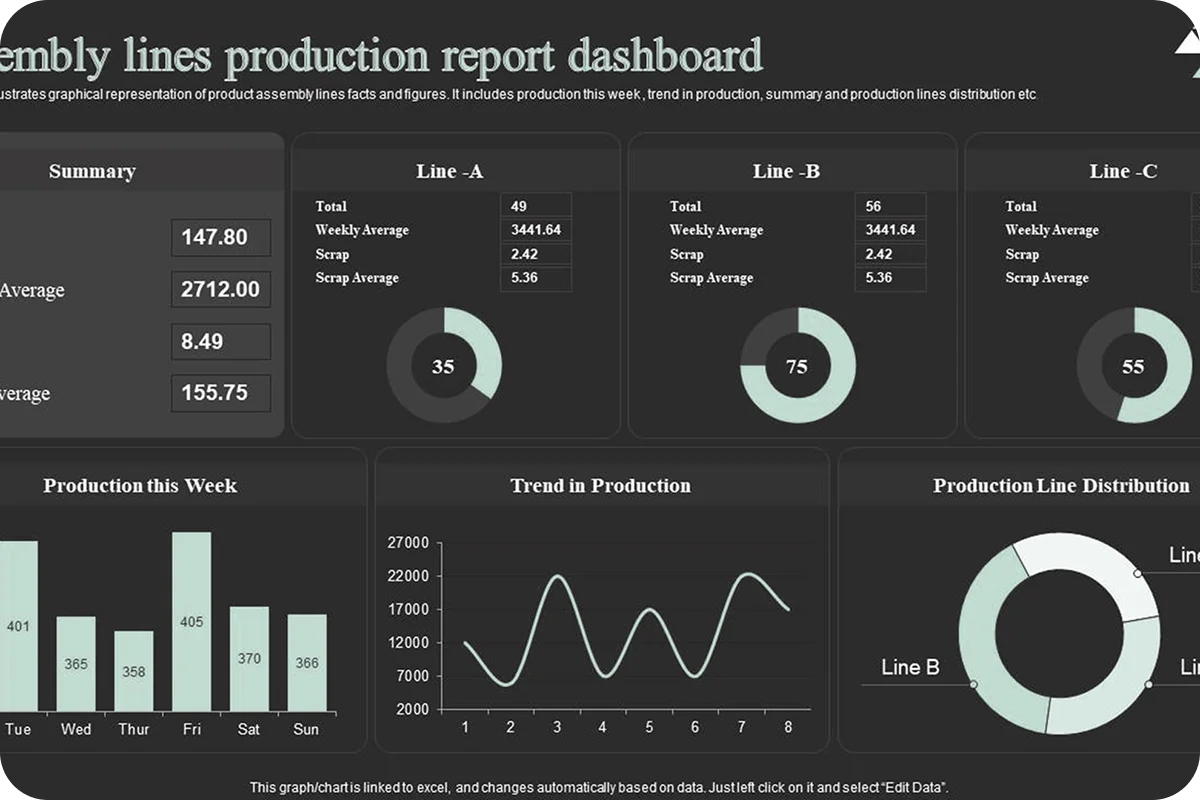

Dashboards for design conversion, margin trends, channel ROI, and forecast accuracy.

Ongoing Optimization

Continuous improvements based on channel performance, pricing outcomes, and demand signals.

Outcomes We Help You Achieve

- 20–40% faster design-win conversions

- 15–30% improvement in forecast accuracy

- Reduced channel conflict and claim disputes

- Stronger margin control across pricing tiers

- Higher trust across OEM, EMS, and distribution partners

- Better visibility across design, pricing, and demand signals